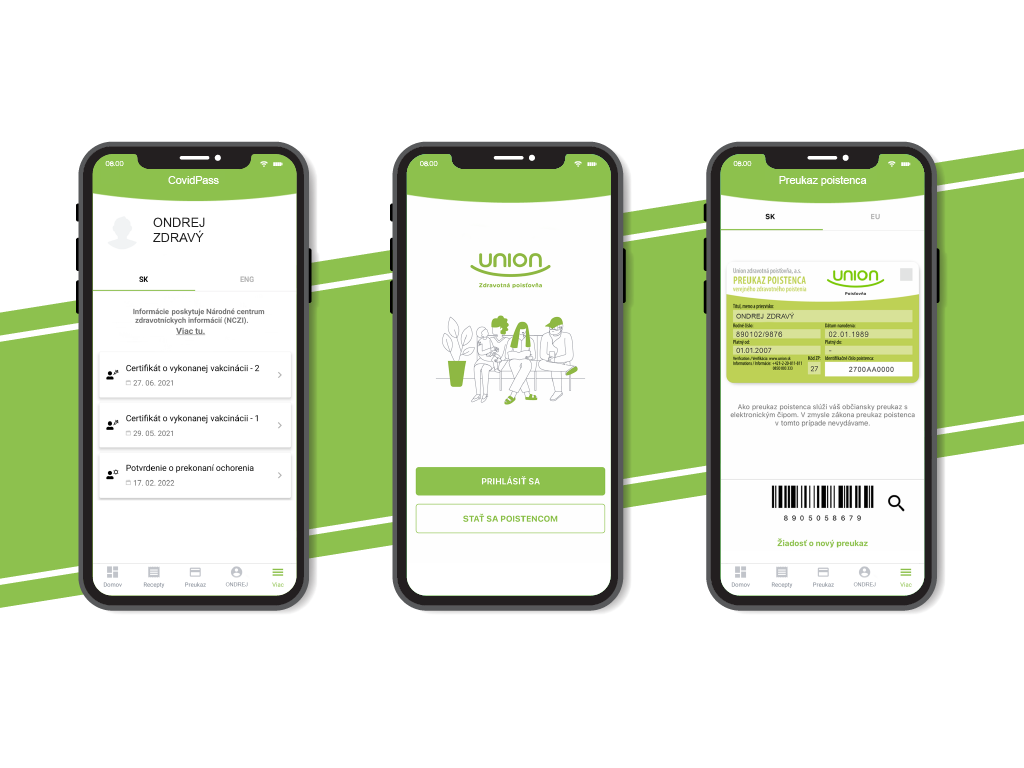

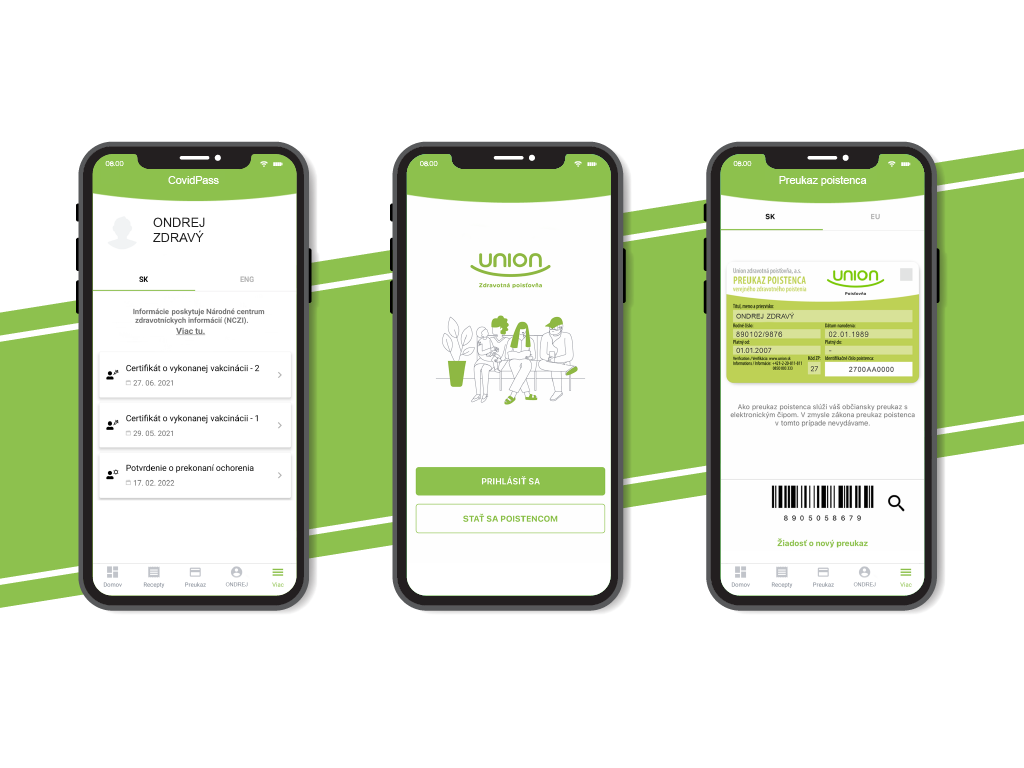

As life moved more and more out of the branch and into the online space, a mobile app was the logical path for Union Insurance.

Our team at the subsidiary company BOOTIQ in the Czech Republic has been working on a mobile application for quite some time. We took over the app from a previous vendor and fundamentally redesigned it. We added many features and thought about the incoming e-prescriptions so that the contact with the insurer would be modern and the insurer would not have to develop a new solution in a year.

Highlights

- Increase in App ratings in stores from 2.9* to 4.5*

- 80- to 100-thousand monthly active users

- Two new major functionalities per year and many smaller ones on an ongoing basis

- Functionality goes into production in 6 weeks from idea

- Exception from Apple regarding payment gateways

- Connection to a new environment in Huawei Store

- Possibility to pay insurance policies or arrears in Tatra banka from the app

Assignment

At first, we were going to incorporate Covid pass into the app, but once we sat down and looked at it from a business and technical perspective, it made more sense to approach it holistically. After the initial technical analysis, we prepared the design and then started developing it. Once completed, we tested it with the client, and when everything was right, we sent it to the individual stores for approval. When they gave us the green light, we launched it for a smaller number of users first and then released it to everyone.

As a health insurer, subject to a lot of legislation and regulations and connected to many systems or databases, we have limited options because health data is even more sensitive than money or bank data. We had to prove, for example, that we are a genuine health insurer that has permission from the Ministry of Health to work with this tool and that it is not a scam.

Solution

We’re developing it continuously in individual feature packs and delivering two major new features per year.

We have divided the project into three parts. The first was the mobile app itself and the remaining two were the backend GraphQL and OAuth. These are used for authentication and token allocation and ensure that the app is more functional and compatible with other systems.

Since satisfaction with the application was quite low after the previous vendor, we had to subject it to a thorough expertise and identify its main shortcomings and potential opportunities.

The result was an increase in store ratings from 2.9* to 4.5*. We made the app faster, reduced the error rate, added offline mode, push notifications, Covid pass and linked it to Tatra Bank. We also connected it to the Huawei Store, which lost access to Google services and had to create its store. Related to this is the implementation of Huawei push notifications, Huawei maps and more, so we are no longer publishing mobile apps only to Google Play and App Store, but also to Huawei Store.

Result

When implementing the Covid pass, we connected through the European Health Service and the Slovak Ministry of Health to a system valid worldwide and had another authority generate the QR codes used in Covid passes for us. And also in offline mode.

When we connected the app to Tatra banka, so that we could pay insurance or arrears from it, we had to implement our own payment gateway, which was particularly difficult with Apple. They only allow you to use the Apple Pay payment gateway and they take 30% of each payment, but in the case of medical payments, the same amount of money as the client sent needed to be sent to Tatra banka’s account.

So we had to negotiate with Apple for a long time to add our payment gateway until they finally made an exception and allowed us to use it.